Open Enrollment

It’s National Primary Care Week and almost Open Enrollment Period - that time of year full of sweat, tears, and spreadsheets. This is a great time to review how you and your family have used health insurance over the past few years.

What services have you utilized frequently?

Not so frequently?

Are your providers mostly in-network? Will they remain so next year?

Out of network?

Have those claims been paid in a timely manner?

How have facility fees impacted you?

What about “ancillary” services like anesthesia? (Personally I consider anesthesia with a colonoscopy pretty necessary…)

Are the medications you take regularly actually covered?

In addition to the above, make sure you understand the following for each plan you are considering:

Do specialist visits require a referral?

What are the premiums and deductibles, and how have those changed from previous years?

Are flexible spending accounts (FSAs), health reimbursement arrangements (HRAs), or health savings accounts (HSAs) an option?

Are copayments and coinsurance required?

What are the out-of-pocket maximums?

Are there any additional benefits like gym memberships, or discounts for completing a wellness assessment?

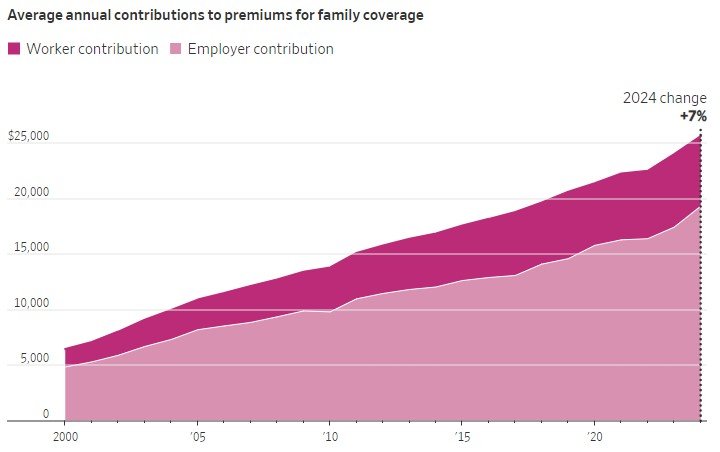

Premiums are up 7% from last year, on top of 7% the year prior. This has added more than $3,000 to the average family premium, which reached roughly $25,500 this year.

These staggering increases likely won’t relent next year either, because the contracts that insurance companies negotiate are typically multi-year. Many employers are trying to absorb this cost, but that often comes at the expense of pay increases and can even mean job cuts. Some employers are even looking into alternative models like individual coverage health reimbursement arrangements (ICHRAs).

Deductibles don’t look much better. These were stable for a few years, but this year rose 4% among large companies and 6% among small companies. Not surprising to anyone who looks at their paystub, the average deductible has grown faster than pay over the past decade.

For reasons more thoroughly addressed in this blog post, many physicians no longer participate with insurance. Those who do participate are overloaded, meaning many no longer accept new patients, have six-month wait times for established patients, and spend seven minutes with you in the exam room.

At the end of the above exercise, you may have noticed that you are paying more for your insurance but getting far less. And no one likes that feeling…especially New Yorkers.

It’s a lot to consider. Talk with your benefits manager, personal accountant, and/or insurance broker.

Should you decide that joining Dr. Dilling Internal Medicine & Pediatrics makes sense for your family, please call 212-390-9294 or email info@drdilling.com I’d love to have you join the practice.